School District Budget Challenges and Financial Insolvency

Contact Information

In Washington state, local school districts are the statutory delivery system of public K–12 education. Each local school district is separately governed by a locally elected board of directors that hires a district superintendent. The school district superintendent is accountable to the board for, among other things, carrying out school district policy and maintaining the financial health of the district.

Financial Health Checklist

When considering the financial viability of a school district, OSPI considers a variety of factors including an assessment of the district’s ability to meet planned expenditure demands while not depleting fund balance. Please refer to the Financial Health Checklist and review a series of questions to which the responses may indicate that a district is more likely to experience financial distress in the next 12 months.

The State's Role

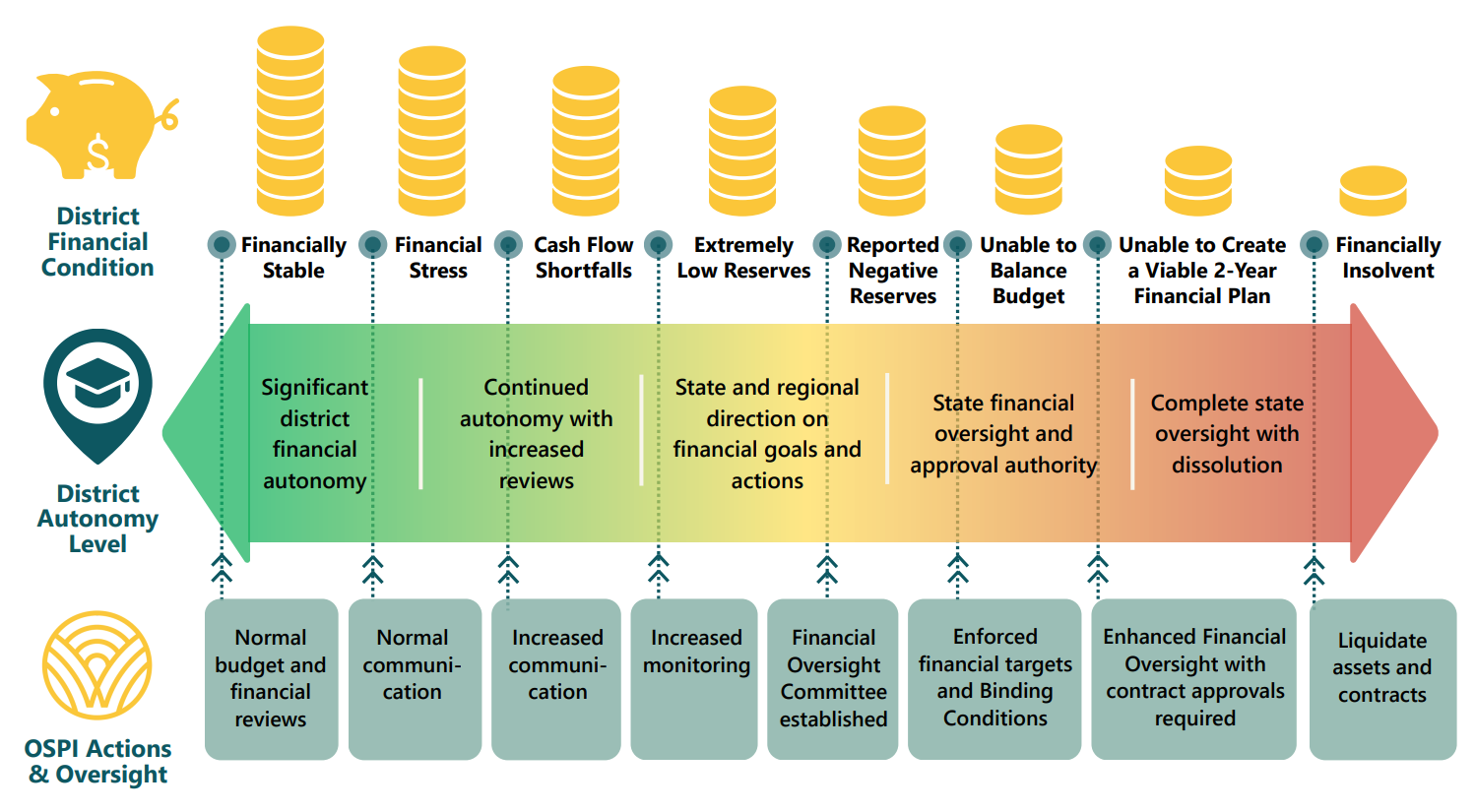

OSPI monitors the financial health of school districts using tools such as a financial health indicators model, monitoring election results, and reviewing budget and financial statements submitted on an annual basis. OSPI’s first choice and preference is for financial challenges to be resolved locally. Local leaders are best situated to make the decisions that impact their students, educators, staff, and families. OSPI’s authority to dictate or approve specific school district financial actions increases as the district’s financial situation worsens.

- School Districts on Binding Conditions

-

- Mount Baker School District

- Prescott School District

- Depositing and Use of Proceeds from the Sale of Real Property (February 11, 2026)

- Notification and Petition for Dissolution (January 12, 2026)

- Recommendations of Prescott Financial Oversight Committee (December 10, 2025)

- Prescott Enhanced Financial Oversight (June 18, 2025)

- Prescott Recommendation to Enhanced Financial Oversight (June 17, 2025)

- Prescott Financial Oversight Committee Members (May 13, 2025)

- Prescott Financial Oversight Committee (April 11, 2025)

- Prescott Binding Conditions Update (October 1, 2024)

- Prescott Binding Conditions Letter (March 11, 2024

-

- Shelton School District

- Mabton School District

- Mabton Binding Conditions Letter (June 4, 2025)

- Bellevue School District

- Marysville School District

- Marysville Updated Binding Conditions (January 13, 2026)

- Change in Level of State Financial Oversight (December 5, 2025)

- Marysville Appointment of Special Administrator (September 16, 2024)

- Marysville Enhanced Financial Oversight (August 28, 2024)

- Marysville Financial Oversight Committee Recommendations (August 26, 2024)

- Marysville Binding Conditions Update (May 23, 2024)

- Marysville Binding Conditions Letter (August 18, 2023)

- Binding Conditions

-

OSPI has the authority to require that local school districts achieve certain financial benchmarks through a process known as Binding Conditions as defined in Washington Administrative Code (WAC) 392-123-060. If a school district is unable to produce a balanced budget, then they must request binding conditions from OSPI. It is only when a district is unable to produce a balanced budget and requests binding conditions from the state that OSPI can get involved.

What is the purpose of binding conditions?

The purpose of binding conditions is to provide the school district with additional oversight and counsel to support the district in returning to a financially healthy position.

What are examples of binding conditions?

Some examples of binding conditions include, but are not limited to, targets for the district’s fund balance, requirements for more frequent financial reporting to OSPI, regular meetings with OSPI, and counseling districts to maximize state funding by meeting certain requirements of law.

What are non-examples of binding conditions?

While OSPI provides oversight and counsel during the binding conditions process, the school district ultimately is responsible for decision-making regarding their financial actions. The following specific actions are not examples of binding conditions: closing schools, eliminating academic or athletic programs, or reducing full-time equivalent staff. Being placed on binding conditions does not nullify or mandate the renegotiation of existing labor contracts.

What if the district’s financial situation does not improve?

If a district is on binding conditions for two consecutive school years and/or is unable to prepare a satisfactory financial plan, the district may enter Financial Oversight.

- Financial Oversight

-

What is Financial Oversight?

This stage of the process requires the convening of a Financial Oversight Committee. The Committee will review the financial condition of a school district and may recommend that a district enter Enhanced Financial Oversight.

What is the role of the Financial Oversight Committee?

The Financial Oversight Committee is convened when a district is in binding conditions and is unable to put together a viable financial plan or is at risk of being financially insolvent within two years without a viable financial plan. The Committee is made up of school district fiscal experts from around the state who assess the school district’s financial plan and can put together an alternate financial plan. The convening of the Financial Oversight Committee requires a public hearing at which feedback can be provided on the district’s financial plan and/or the alternate plan produced by the Committee.

What type of authority does the Financial Oversight Committee have on local decision-making?

The Financial Oversight Committee may refer the district to participate in Enhanced Financial Oversite, thereby exercising full control over all financial decisions impacting the school district.

What happens if dissolution of a school district is recommended?

School district dissolution occurs when a district has no other option but to be consolidated with one or more neighboring school districts. In the last 25 years, just one Washington school district has gone through the dissolution process.

- Apportionment Advance

-

What is an apportionment advance?

The state allows school districts to receive apportionment funds in advance of the schedule defined in state law in unforeseen and emergent situations. This could be an emergency cash flow solution for districts and should not be considered a budget balancing strategy.

Districts with Apportionment Advances

When can districts receive an advance and repayment requirements?

(1) A district must have an unforeseen condition causing the need for the emergency advance that could not have been anticipated by a reasonably prudent person.

(2) The district must demonstrate a need for the advance, taking into account all outstanding interfund loans, tax anticipation notes, and anticipated cash and investment balances.

In no case can a district repay and then re-advance funds in subsequent months.

Minimum Repayment Required Advance Month No Later than June 30 July August October - May 50% 50% June n/a 50% 50% July n/a n/a 100% August - September Advances not granted during these months How is the maximum advance calculated?

The maximum apportionment advance that a local education agency (LEA) can be approved to take is based on the lessor of:

- The requested amount in a local education agency's board approval or charter school's resolution.

- The highest negative month-end monthly cash and investment balance of the general fund between the date of the resolution and May 31st of the school year less any redirection of a school district's or charter school's basic education allocation to the capital projects fund, debt service fund, or both.

- An amount not to exceed 10% of the total amount to become due and apportionable to the district or charter school from September 1 through August 31 of the school year (revenue 3100).

Maximum allowable apportionment advance will be calculated by the SAFS team using actual enrollment (AAFTE) and an LEA's cash flow statement beginning with the month of the advance through the end of the school year.

OSPI may not approve advance requests that require repayment in July and August when expected appropriation authority suggests these advances would require apportionment to be short paid in the current state fiscal year.

How to initiate this process?

To initiate the process of an apportionment advance, the local education agency business officer should send an email T.J. Kelly, Jackie McDonald, or SAFS. Requests will need to include cash flow statement beginning with the month of the advance requested through the remainder of the school year.

Timing: SAFS Team recommends reaching out no later than the last week of the previous month the advance is needed. Calculations for max amount and board approvals can take time, and apportionment is run the day after enrollment is due each month. This is especially true if taking an advance during the months of October - December when we are still running apportionment on budgeted enrollment.

What does an Apportionment Emergency Advance Sample Board Resolution look like?

Apportionment Emergency Advance Sample Board Resolution

What are the associated rules with Apportionment Advances?

- WAC 392-121-436: Emergency Advance Payments - School district application

- RCW 28A.510.250: Apportionment schedule by state superintendent

- WAC 392-121-438: Emergency Advance Payments - Approval criteria

- WAC 392-121-440: Emergency Advance Payments - Determination of amount

- WAC 392-121-442: Emergency Advance Payments - Forfeiture of earnings on emergency advance

- WAC 392-121-443: Emergency Advance Payments - Repayment of advances

- School Districts Exited from Binding Conditions

-

La Conner School District

- La Conner Formal Release of Binding Conditions (November 17, 2024)

-

- La Conner Binding Conditions Update (January 12, 2024)

Tukwila School District